Disclosure based on TCFD recommendations

Supporting the TCFD and disclosing information based on its recommendations

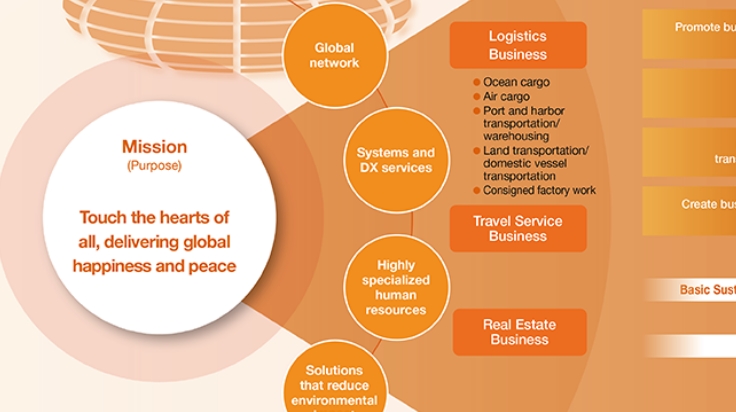

Our group recognizes that responding to climate change is an important management issue, and has set "realizing a carbon-free society and contributing to an environmentally friendly recycling-oriented society" as one of our key sustainability issues (materiality). To address these issues, we are working on sustainability activities to reduce the environmental impact through our business, particularly by reducing greenhouse gas (GHG) emissions, specifically by switching to renewable energy, introducing environmentally friendly facilities and vehicles, and promoting modal shifts.

In order to continue to strengthen and promote our activities through our business, on June 19, 2023, we announced our support for the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) and disclosed information on the four areas of "Governance," "Strategy," "Risk Management," and "Metrics and Targets" based on the framework of the recommendations. We have now decided to expand the scope of these efforts from our company alone to the entire group, including domestic and overseas subsidiaries.

We will continue to regularly review the identified climate change risks and opportunities, reduction targets, etc., and strive to enhance information disclosure, such as disclosing climate change information as appropriate. Furthermore, by implementing measures to reduce GHG emissions, we aim to realize a sustainable society and increase our corporate value.

-

TCFD: An international framework that encourages companies to specifically disclose climate change-related risks, opportunities, and initiatives.

For more detailed disclosure information, please see below.

Governance

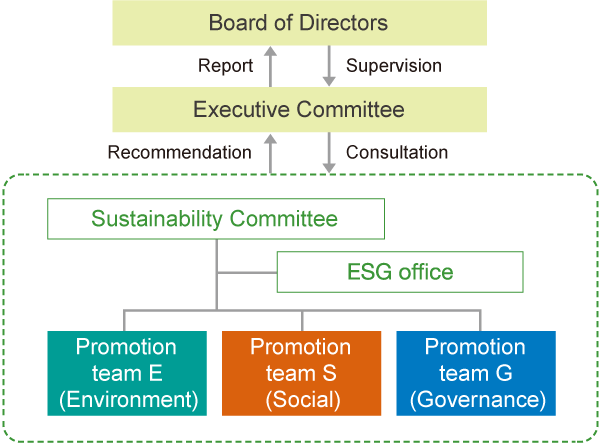

The Group recognizes that climate change risk is one of its major risks and that responding to it is one of its key management issues. In order to respond to climate change in an organized manner, we have established a Sustainability Committee, chaired by the President and CEO.

As an advisory body to the Executive Committee, the Committee will identify, assess and manage climate change-related risks and opportunities, set targets for reducing greenhouse gas (GHG) emissions including CO2, plan measures, draft proposals and monitor progress, and report to the Executive Committee.

The results of these meetings are then reported to the Board of Directors, and important matters are resolved by the Board of Directors, creating an effective system.

- ■Board of Directors:

-

Through reports from the Management Committee, the Committee oversees the identification and assessment of risks and opportunities related to climate change, related indicators and targets, and the progress of measures, and makes decisions on important matters.

- ■ Management Meeting:

-

Under the supervision of the Board of Directors, the Sustainability Committee is consulted, its recommendations are discussed, and a report is made to the Board of Directors.

- ■Sustainability Committee:

-

As an advisory body to the Management Committee, it deliberates and reports to the Management Committee on the assessment, identification, and management of risks and opportunities related to climate change, the setting of related indicators and targets, and countermeasures.

- ■Sustainability Promotion Office:

-

The Sustainability Committee will report to the Sustainability Committee on identifying climate change-related risks and opportunities, setting related indicators and targets, and countermeasures, etc. It will also serve as the committee's secretariat.

Strategy

Identifying risks and opportunities and analyzing scenarios

We identified the risks and opportunities that climate change will have on our Group's business activities in the medium to long term, and assumed a world in which the global temperature rise from the pre-industrial revolution average was 1.5°C or 4°C, and considered countermeasures to these risks and opportunities and analyzed the financial impact as of fiscal year 2030. The worldviews for each assumed scenario are as follows:

- Worldview (as of 2030)

-

In the 1.5°C scenario, transition risks increase due to the expansion of stricter decarbonization regulations and initiatives than in the 2°C scenario, while physical risks are suppressed.

-

The spread of EVs and FCVs is expected to continue, with their share of passenger cars expected to double compared to the below 2°C scenario, and for trucks, their share expected to increase by about four times. Oil demand will continue to decline until 2030.

-

Compared to the 2°C or less scenario, hydrogen utilization will progress further, with investments about three times as much as in the 2°C or less scenario made between 2022 and 2030. Low-cost hydrogen supply will be realized with the introduction of renewable energy and the widespread use of CCUS (carbon capture, utilization and storage).

-

Regulations will be stronger than in the 2°C scenario, and efforts to reduce emissions will accelerate in non-energy industrial sectors such as steel, cement, and plastics.

-

- Main references

-

WEO2022(NZE)

IPCC AR6 SSP1-1.9

- Worldview (as of 2030)

-

Physical damage caused by climate change will affect business (mainly physical risks)

-

The economy will continue to depend on fossil fuels, leading to rising fossil fuel prices.

-

Climate change regulations will remain as they are today and will not be fully implemented

-

Temperature differences with other scenarios will begin to appear, and the frequency and severity of natural disasters caused by extreme weather will increase, as well as the working environment becoming worse.

-

- Main references

-

WEO2022 (STEPS)

IPCC AR5 RCP8.5

IPCC AR6 SSP5-8.5 etc.

Risks and Countermeasures

The financial impacts of the identified risks and scenario analysis are as follows:

| Major classifi-cation | Middle classification | Identified risks | Impact | Time axis | Influence | Counter-measure | |

|---|---|---|---|---|---|---|---|

| 1.5℃ | 4℃ | ||||||

| Transfer | Policy and law | Cost increase due to introduction of carbon tax | Large | Large | Medium | Increase in payment costs due to introduction of carbon tax imposed on GHG emissions |

|

| Increase in vehicle purchase costs due to conversion to low-carbon vehicles | Large | Large | Medium | Increase in purchasing costs due to replacement with expensive low-carbon vehicles such as EVs and FCVs |

|

||

| Increase in capital investment costs due to stricter regulations on refrigerants such as CFC substitutes | Small | Small | Medium | Increased costs associated with upgrading to natural refrigerant equipment due to stricter regulations on refrigeration and freezing equipment that use CFC substitutes |

|

||

| Technical reputation | Sales decline due to lack of response to customers who place emphasis on low-carbon transportation | Large | Small | Medium | Lost customers and decreased sales due to insufficient response to increased demand for low-carbon transportation due to increased environmental awareness among customers and strengthened efforts to reduce GHG emissions |

|

|

| Physics | Acute | Increase in facility damage and compensation costs due to severe wind and flood damage | Medium | Large | Short | Due to the increasing frequency of wind and flood damage caused by rising temperatures, damage to warehouse equipment and consigned cargo is occurring, resulting in repair costs and compensation costs. |

|

| Increase in repair costs for coastal area logistics bases due to sea level rise | Large | Large | Medium | The probability of flooding due to storm surge due to sea level rise is increasing, and repair costs will be incurred due to damage to buildings and equipment at warehouses and business offices. |

|

||

| Chronic | Decrease in work efficiency due to rising temperature and increase in costs for countermeasures (air conditioning, etc.) | Small | Small | Medium | Employee work efficiency and productivity will decline as temperatures rise, and air conditioning costs will increase to deal with this. |

|

|

- Time axis

-

-

Short-term: FY2026 (final year of the 7th Medium-Term Business Plan)

-

Medium-term: FY2030

-

Long-term: FY2050

-

- Financial impact

-

Financial impact is assessed as large, medium, or small based on qualitative and quantitative perspectives

-

Evaluation based on the activity data of Nissin Corporation and all consolidated subsidiaries. Also includes a scenario of less than 2°C in some cases.

-

Opportunities and Responses

The identified opportunities and their financial impacts through scenario analysis are presented below.

| Major classifi-cation | Middle classification | Identified risks | Impact | Time axis | Influence | Counter-measure | |

|---|---|---|---|---|---|---|---|

| 1.5℃ | 4℃ | ||||||

| Opportunity | Resource efficiency | Reducing fuel costs by improving vehicle fuel efficiency | Large | Medium | Medium | Fuel cost reduction due to improved fuel efficiency with the introduction of EV/FCV |

|

| Improving logistics efficiency by introducing new means of transportation | Medium | Small | Medium | The introduction of DX to improve energy efficiency and expand low-emission logistics services will contribute to cost reductions by improving work efficiency and reducing equipment such as owned vehicles. |

|

||

| Increase in sales by providing new services utilizing DX/IoT | Large | Small | Medium | Increased sales due to improved energy efficiency through the introduction of DX/IoT and expansion of low-emission logistics services that are chosen by customers with high environmental consciousness. |

|

||

| Energy source | Acquire customers and increase sales by introducing environmentally friendly services | Large | Small | Medium | Sales will increase as environmentally conscious services that use lower-emission transportation methods and fuel are chosen by environmentally conscious customers. |

|

|

| Market | Increase in profits through new business development into EVs, hydrogen fuel, etc. | Large | Large | Short | Increase sales by entering and expanding EV and hydrogen-related businesses and developing new markets |

|

|

| Resilience | Increased sales due to increased trust from customers by maintaining logistics functions and transporting goods in the event of a disaster | Small | Medium | Medium | Increase sales by strengthening measures and collaboration to minimize damage during disasters and gaining trust from customers. |

|

|

- Time axis

-

-

Short-term: Fiscal year 2026, the end of the 7th Medium-Term Business Plan

-

Medium-term: FY2030

-

Long-term: FY2050

-

- Financial impact

-

Assess financial impact based on qualitative and quantitative perspectives as large, medium, or small

-

Evaluation based on the activity data of Nissin Corporation and all consolidated subsidiaries. Also includes a scenario of less than 2°C in some cases.

-

Risk management

In order to identify risks that could have a significant impact on management from a company-wide perspective and take appropriate measures, the Group has established a Risk Management Committee based on the Risk Management Regulations. The Risk Management Committee is chaired by the Executive Officer in charge of risk management, and the Representative Director and President serves as the chief executive officer of risk management for the Group. In particular, with regard to climate change-related risks, in addition to evaluations by the Sustainability Committee, the Risk Management Committee will evaluate and monitor from a company-wide perspective.

In addition, risks identified as significant risks by the Risk Management Committee are discussed and approved by the Executive Committee and the Board of Directors, after which they are recognized as significant risks for the Group, and countermeasures are considered and implemented.

Metrics and Goals

Index

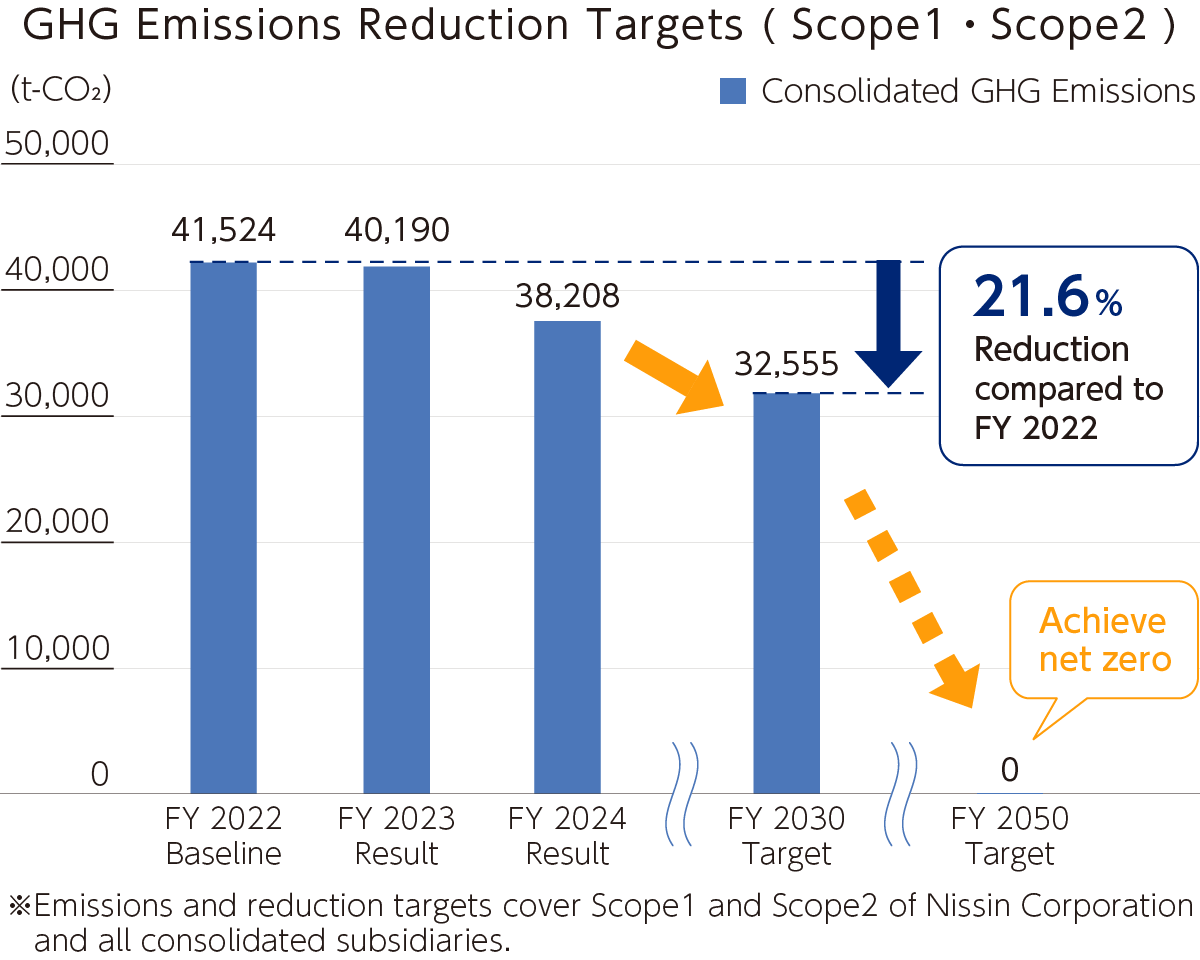

Our Group's consolidated greenhouse gas (GHG) emissions (Scope 1, Scope 2)

The Goal

2.7% reduction per year (21.6% reduction by FY2030 based on FY2022 standard)

Aiming to achieve carbon neutrality by 2050

Scope 1

-

Upgrading to environmentally friendly vehicles such as EVs and FCVs

-

Alternatives to biofuels, etc.

-

Switching from fluorocarbon refrigerants to natural refrigerants in refrigeration and freezing equipment

-

Efficient use of company vehicles by promoting joint transportation and modal shift

Scope 2

-

Expanding the number of locations where renewable energy power is introduced

-

Introduction of natural energy sources such as solar power generation

-

Promoting energy conservation through the conversion of facility lighting to LEDs, etc.

-

Reducing energy consumption through digital transformation

-

Purchasing non-fossil certificates

- Also recommended

Please feel free to contact us. Our sales representative will explain the details in detail.